The Thief in the Office: Embezzlement Risks and Prevention for Businesses

- Michael Jesse

- 4 hours ago

- 7 min read

“You didn’t hire a criminal; you created a thief through your own negligence. We like to call it 'loyalty,' but in the forensic world, we call it an 'unlocked door.' If you are running your organization on the hope that people are good, you aren't a leader—you’re a mark. And right now, the person you trust the most is likely the one making you pay for that mistake.”

TL;DR Diagnostic Summary: The Price of Passive Management

For the busy Executive or Director, here is the forensic reality of your current oversight strategy. If these numbers don't sit well with you, it’s because the system is working exactly as it was designed—to harvest your capital while you aren't looking.

The 5% Revenue Tax: According to the 2024 ACFE Report, the average organization loses 5% of its annual revenue to internal fraud. Calculate that number for your business right now. That is the price of your current "Trust-Based" system.

The Median Devastation: For small-to-mid-sized businesses, the median loss is $141,000. This isn't a "one-time" theft; it is a slow bleed that typically goes undetected for 14 to 24 months.

The Legal Liability: Under the Duty of Oversight, "I didn't know" is no longer a defense. Landmark court findings (like Lemington Home) have held directors personally liable for millions due to "blind deference" to trusted staffers.

The Red Flag Reality: 87% of embezzlers are first-time offenders with no criminal record. They don't look like thieves; they look like your most "dedicated" employees who never take a vacation.

The Anatomy of Betrayal: Why Embezzlement is Happening Right Now

“The most dangerous embezzlers don’t look like criminals. They look like the employee of the month. They are the first to arrive and the last to leave—not because of their work ethic, but because they cannot afford to let the 'static' in your ledger be seen by anyone else.”

The Mutation of the "Trusted Insider"

Embezzlement is rarely a pre-meditated heist. It is a slow mutation that occurs when three specific forensic conditions align—a concept known as the Fraud Triangle.

Pressure (The Fuel): Behind the "dedicated" facade, there is a secret. It might be a gambling debt, a medical crisis, or a lifestyle they can no longer sustain on their salary. They don't want to steal; they need to survive.

Rationalization (The Spark): To live with themselves, the thief must rewrite the narrative. They tell themselves, "The Board doesn't even look at the grant overhead," or "The Owner is taking three vacations this year; they won't miss this 'dividend'."

Opportunity (The Unlocked Door): This is where your negligence becomes their invitation. You provided the opportunity by failing to implement internal financial accountability. By giving one person the keys, the checkbook, and the final word on reconciliation, you created a single point of failure.

In the forensic world, we don't blame the fuel or the spark—we blame the person who left the vault open.

Court Findings: The “Duty of Oversight” is Not Optional

“In the eyes of the law, 'I didn’t know' is no longer a defense—it is a confession. If you are not actively defending your organization, you are legally complicit in its destruction.”

For the Business Owner or Non-Profit Director, the financial loss is only the first wave of devastation. The second wave is the legal reckoning. Landmark court findings have established that a "passive" leadership style is a breach of fiduciary duty.

The Lemington Home Verdict: $2.25 Million in Personal Liability

In the landmark case In re Lemington Home for the Aged, the court held non-profit directors personally liable for millions in damages. The court's reasoning was clinical: The directors didn't steal a dime, but their "blind deference" to a trusted insider allowed the organization to be bled dry.

The ruling established that a board’s failure to investigate "red flags" is not just bad management—it is gross negligence. If your board of directors is simply rubber-stamping reports once a quarter, you are currently operating without a legal shield.

The Caremark Standard: You Must Have a System

Under the Caremark Standard, directors and owners have a legal obligation to ensure that "information and reporting systems" exist to identify risk. If you do not have a Specialist Bolt-On—a forensic team that audits the "Grid" of your transactions—you are failing the minimum legal requirement of your role.

The law protects the vigilant. It penalizes the "stones growing moss" who refuse to take a second look.

The Invisible Evidence: Red Flags You Are Choosing to Ignore

“You haven’t noticed the theft because you are looking for a villain in a mask. But in the forensic world, the thief doesn't look like a stranger; they look like the employee you’d trust with your house keys. Your refusal to see the evidence isn't kindness—it is a choice to remain a mark.”

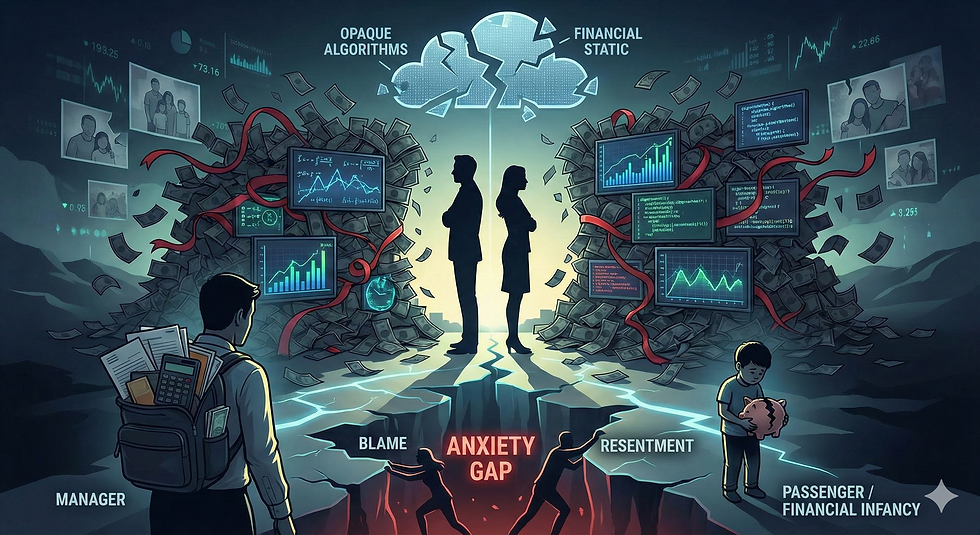

Embezzlement is a crime of proximity. It thrives in the "Anxiety Gap"—that space where you feel something is wrong but you are too polite to ask for the data. Here are the silent alarms currently ringing in your organization.

The "Dedicated" Gatekeeper (The Vacation Test)

We often hear owners praise an employee who "never takes a day off" or "hasn't had a real vacation in years." In a healthy organization, this is a recipe for burnout. In an embezzling organization, this is a Defensive Necessity.

The Logic: An embezzler cannot afford to let another set of eyes see the "Grid." Their system requires daily manual intervention to hide duplicate payments, reroute refunds, or balance "ghost" ledgers.

The Test: Mandate a 10-day consecutive vacation where the employee has zero remote access to the books. If they become defensive, emotional, or try to "work from the beach," you aren't looking at dedication. You are looking at a fortress.

The Lifestyle Mismatch

Forensic data shows that "Living Beyond Means" is the #1 behavioral red flag, present in nearly 40% of all cases. You know what your staff makes. If the math of their life doesn't match the math of their salary, you are likely the silent benefactor of their luxury.

The Clues: A mid-level administrator driving a high-end European SUV; a bookkeeper taking multiple international trips; designer handbags appearing in an office that pays $45,000 a year.

The Shame: You aren't "happy for their success." You are being robbed. Every luxury they flaunt is a dividend paid for by your missing margin.

Chaos as a Cloaking Device

When you ask for a specific report or a look at the bank reconciliation and hear, "I'm still cleaning that up," or "The books are a bit of a mess right now," pay attention.

The Tactic: Thieves use "Messy Bookkeeping" as a shield. By keeping the records in a state of perpetual disarray, they ensure that a "Generalist" (like your standard CPA) can't get a clear snapshot without a massive billable-hour project.

The Reality: Professionalism is transparent. Chaos is a choice. If they are "gatekeeping" the information, they are gatekeeping the truth.

The "Small Stuff" Leakage

Embezzlement in 2026 often hides in the digital stack—the areas where Business Owners and Directors feel the most "Forensic Fatigue."

The Amazon Pivot: Personal items bought on the company’s tax-exempt Amazon Business account.

The Merchant Ghost: Small, recurring "processing fees" that are actually being routed to a personal Square or PayPal account.

The 1099 Mirror: A vendor name in your ledger that is one letter off from a real utility or software provider, but the funds are being routed to a personal P.O. Box.

The Intervention: Transitioning from “The Mark” to “The Guardian”

“The shame of being robbed isn't found in the loss of capital; it’s found in the choice to let it continue. You can spend another 14 months hoping your intuition is wrong, or you can spend 5 minutes proving it. The Silent Divorce between your leadership and your legacy ends the moment you hire a Guardian.”

You are currently at a crossroads of Institutional Friction. If you continue to rely on "politeness" as your primary oversight tool, you are effectively a co-conspirator in your own organization’s destruction.

At 2nd Look Services, we act as the Specialist Bolt-On to your existing team. We don’t replace your CPA; we provide the forensic specialized "surgery" that generalists aren't equipped to perform. We operate on a 100% Contingency Basis—if we don’t identify a recovery or a leak, you don’t pay.

Option A: The Immediate Intervention (Strategy Call)

For the leader who knows something is wrong and needs to secure the fortress today. This is a 5-minute Forensic Strategy Call.

The Goal: To provide you with a "Lockdown List" of documents to secure immediately without tipping off your internal staff.

The Promise: No sales pitch. No small talk. Just a clinical assessment of your current exposure.

Call Don Zavis at +1 (248) 497-5869.

Option B: The Organizational Stress Test (Digital Diagnostic)

For the leader who needs forensic proof of the "Opportunity" for theft before they act.

The Goal: A 5-minute diagnostic scan of your current oversight circumstances.

The Result: We identify the specific holes in your "Grid" where your capital is most likely being harvested—from duplicate vendor leakage to merchant fee manipulation.

Comments