The Blueprint for a Broken Home: Why “Financial Passivity” is a Form of Negligence.

- Michael Jesse

- 6 hours ago

- 3 min read

“Most marriages don’t end because the flame went out. They end because the oxygen was stolen. You aren’t fighting about the dishes; you’re fighting because 'The System' has bled your bank account so dry that you have no margin for error—and no room for grace. Poverty isn't always a lack of income; often, it's a failure of defense.”

The Diagnosis: The High Cost of Lacking Household Financial Accountability

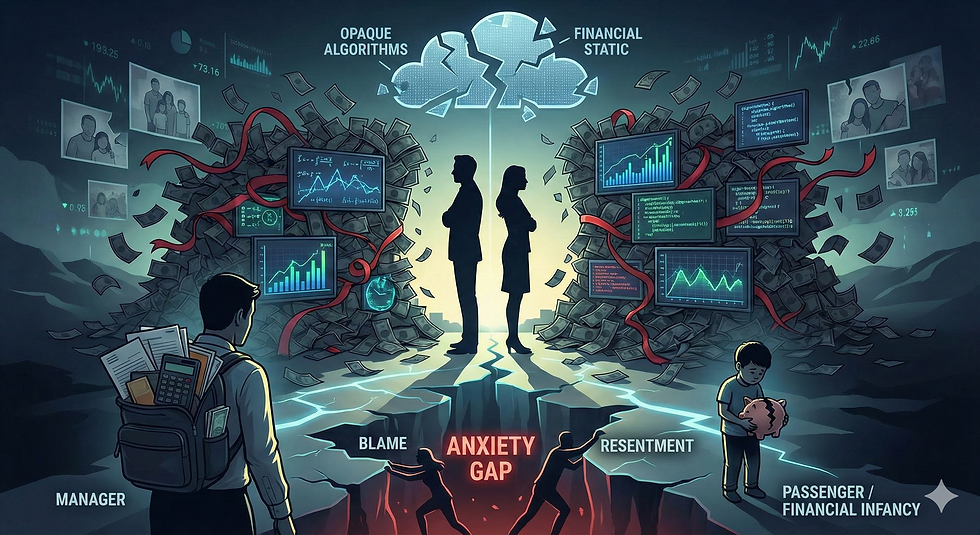

In a world where financial systems are designed for the "average" and governed by opaque algorithms, a lack of household financial accountability is a recipe for disaster. We call the result the Silent Divorce. It is the gradual, painful decoupling of a partnership caused by the "static" of unresolved financial circumstances.

The Divorce Catalyst: Data from MagnifyMoney proves that 21% of divorcees cite money as the primary cause of their split. The deeper forensic truth? One out of every three couples reports that financial stress has actively dismantled their emotional intimacy.

The Anxiety Gap: 77% of Americans feel anxious about their money, yet only 32% take action to maintain a forensic view of their P&L. That 45% "Anxiety Gap" is where resentment grows. It is where you stop being partners and start being "accountants of blame."

The Single Point of Failure: Financial passivity usually forces one partner to be the "Manager" and the other to be the "Passenger." This is a structural failure. If the Manager is sidelined, the Passenger is left in Financial Infancy, completely defenseless against a world that doesn't care about your family's survival.

Institutional Friction: The $14,400 "Ignorance Surcharge"

Your household is leaking money because the systems we live in—tax codes, insurance premiums, and medical billing—are optimized for the institution, not the individual. When you refuse to address these circumstances, you are effectively paying an "Ignorance Surcharge" to the status quo.

Stolen Memories & Stolen Money

The Annual Levy: The average high-earning household we audit is leaking roughly $1,200 a month simply because they are too "busy" to check the math.

The Opportunity Cost: Over a decade, that is $144,000. That isn't a theoretical number. That is a 7-day family vacation every single year. It is the cost of your child’s braces or two years of university tuition.

When you sit on the couch and ignore a property tax assessment that doesn't account for market shifts, or you keep paying PMI after your home has appreciated, you aren't just losing money—you are choosing to give your family's future to a system that doesn't even know your name.

The Forensic Evidence of Your Inaction

80% of Hospital Bills contain errors. This isn't malice; it's the collision of human error and automated complexity. If you don't audit, you are volunteering to pay for the friction.

$70 Billion in unclaimed property is currently held by state treasuries. 1 in 7 Americans has assets—old deposits, forgotten 401Ks, or uncashed checks—sitting in a vault. By remaining passive, you are providing an interest-free loan to the government while your own marriage struggles under the weight of "scarcity."

The Protocol: Reclaim Your Shared Reality

At 2nd Look Services, we don't judge your spending. We perform Forensic Wealth Recovery. We are the Specialist Bolt-On that brings the secrets of the ultra-wealthy to the everyday homeowner.

The Silent Divorce is a choice. You can keep letting financial passivity erode your home, or you can hire a Guardian to stop the bleeding.

Choose Your Level of Defense

Option A: The Immediate Intervention

Make a 5-minute Forensic Strategy Call. We don't do small talk. We identify the specific "Institutional Friction" points in your life and tell you exactly how to plug them. Call Don Zavis at +1 (248) 497-5869.

Option B: The Digital Diagnostic

Not ready to talk? Complete our 5-minute Household Stress Test. Our algorithm will scan your circumstances to identify potential recovery opportunities in property tax, insurance, and unclaimed assets.

Comments